The banking industry is trending up. With greater accountability and transparency in our institutions, customers are finally coming around to their banks. Confidence is being restored and their trust is growing. For once, the future of banking looks quite bright.

But competition is also on the rise. Customer loyalty can't be taken for granted. Things like security and convenience, once tokens of a great and stable bank, are now merely assumed. New expectations include fewer fees, more personal insight and better online banking features. Bank customers want more, and they are putting a greater burden on financial service providers to step up their game.

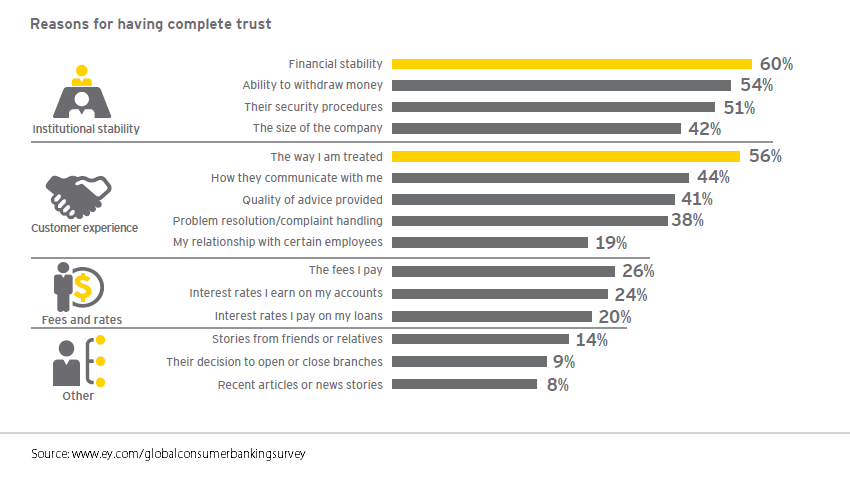

How can financial institutions earn complete trust from their customers? According to Ernst & Young (chart below), it means providing stability as well as an excellent customer experience. (Though, of course, I would be remiss if I didn't mention the need for transparency in fees/costs).

With this in mind, how can banks look to improve their digital strategies as they plan ahead? Three key strategies appear to be of the most immediate concern.

1. Focusing on the Omnichannel Experience

Let's start by thinking about some of your major channels—mobile, online, in-person/branch—and how you can improve customer satisfaction in each one.

Traditionally, branches were where people performed most financial transactions. The staff, branch locations and resource management all played a big part in why a customer might open an account. But times have changed. With costly overhead, human resources, and the shift to mobile self-service, it makes sense to invest in the virtual banking.

Think about how you can deliver some of these branch services via online or mobile channels. Find a way to create easy-to-use digital channels for day-to-day transactions. Streamline ways to sell products through the web. When you've developed a seamless omnichannel banking experience, you'll be able to gain deeper product penetration and expand your portfolio.

2. Providing Personal Insight and Wisdom for Financial Needs

Use all the data you have available about your customers to their advantage. Help them customize financial plans and long-term goals. Mint.com is a good example of a digital finance manager. It keeps track of a person's spending history and recommends certain products or online banking services based on that information. It can also track when bills are due and when a credit limit or budget is reached. This functionality will not only help your customers draft clearer financial plans, but it will also show your personal investment in their future.

Keep in mind, this point is applicable even if your technology is not quite in place. When it comes to financial advice, many people still enjoy speaking to someone at a branch or call center. So it's important to equip your advisors with the right skills and a customer-first attitude; look to demonstrate your expertise and concern while building customer trust in the process.

3. Finding Ways to Improve Margins and Productivity

This idea might not sound revolutionary, but the principle remains when applied to a bank’s digital strategy. How do you trim the fat from current operations or processes? Given the lack of loan and revenue growth, are there any back office costs you can eliminate in order to improve margins and productivity? As McKinsey & Company notes in their report, Global Corporate and Investment Banking: An Agenda for Change, "Corporate banks should consider ways to make their models 'capital-lite'. Banks can often switch to products that offer similar economics, but require less capital." Think of it as pruning: reducing capital waste and tightening your operations will prepare you for growth of new branches (no pun intended).

If your financial institution is able to execute on these digital strategy action items, you'll be on the right track to earning genuine loyalty. Your customers will be happier and more confident in your ability to solve their problems. And you'll have less to worry about the competition.